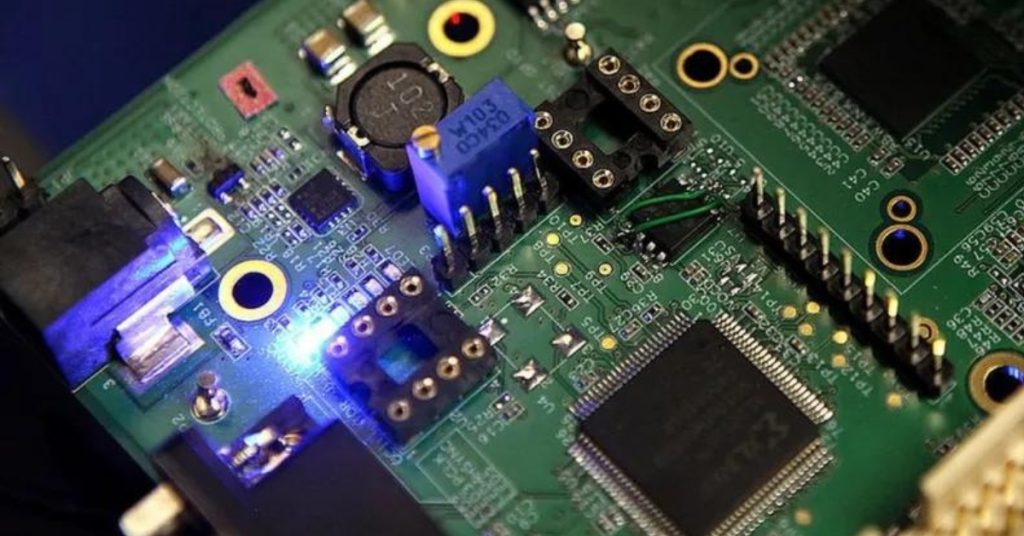

The CEO of Cisco, Chuck Robbins, has predicted that the global chip shortage will persist through much of this year. The scarcity, initially triggered by the Covid pandemic and worsened by other factors, has delayed production across various sectors.

Robbins told the BBC, "We think we've got another six months to get through the short term. The providers are building out more capacity, and it'll get better and better over the next 12 to 18 months."

This expansion is essential as emerging technologies like 5G, cloud computing, IoT, and AI fuel a surge in demand for semiconductors. Robbins' perspective is influential, given that Cisco systems handle 85% of internet traffic.

"Right now, it is a big problem," Robbins emphasized, "because semiconductors go in virtually everything." The intense demand is why Intel has announced a $20 billion plan to expand production, including two new plants in Arizona.

Dan Ives, a tech analyst at Wedbush Securities, noted that current demand is about 25% higher than expected. Despite the short-term shortage, tech share prices remain strong due to investor confidence in long-term demand.

President Joe Biden views the chip shortage as a critical issue, urging business leaders to position the US as a leader in semiconductor production. The US Semiconductor Industry Association highlights that 75% of global manufacturing capacity is in East Asia, dominated by Taiwan's TSMC and South Korea's Samsung.

European politicians also push for more local chip production, partly driven by concerns over China's interest in Taiwan. Meanwhile, China faces a surge in domestic chip demand but holds a small share of global manufacturing.

Robbins believes the location of chip production is less important than having multiple sources. However, Intel CEO Pat Gelsinger told the BBC it's not "palatable" to rely heavily on Asia for chips.

TSMC is investing $100 billion over three years to maintain its lead as the world's largest contract chip manufacturer. Morris Chang, TSMC's founder, urged the Taiwanese government to "keep hold of it tightly," arguing Taiwan is better positioned than the US or China.

The pandemic exacerbated the chip shortage, as companies initially cut orders, anticipating reduced demand, leading suppliers to scale back capacity. However, consumer electronics demand surged, straining supply. Other factors, such as a factory fire and adverse weather, have compounded the issue.

Paul Triolo from Eurasia Group noted that a generational technological shift has created unprecedented challenges for the industry. He stresses the need for diverse supply sources to prevent future shortages. Long-term solutions are necessary to address the concentration of semiconductor manufacturing.

Robbins warns against consolidation, which could amplify risks such as weather-related disasters or geopolitical tensions. Cisco recently acquired Acacia Communications for $4.5 billion but has no plans to manufacture its own chips, leaving it to specialized firms.

The high cost of chip production facilities means they operate near full capacity, and meeting increased demand will take time. Triolo mentioned that the scale of demand remains uncertain, with companies overordering components to avoid future shortages.

Comments (0)